The Best Payroll Software For Small Businesses Fundamentals Explained

Featured Partners What are payroll solutions? The most common kind is payroll solutions like payroll invoices. Although the relevant information is not saved safely and securely, the company is provided with a duplicate of your payment slip and an attached spread sheet specifying your pay-roll overalls. The spread sheet has a listing of your salaries and a link to your payroll document to assist make it easier in the future. These companies allow you to track the total volume and worth of your settlements. Find additional at pay-roll services and pay-roll file.

Payroll bodies deal with and automates worker settlements. Employee's Cash Rewards Perks of Employee Cash Rewards. Perks of Employee Cash Rewards are consisted of in pay-roll advantages, staff member retirement life or insurance benefits, unemployment insurance coverage, wellness financial savings profiles, little one treatment contributions and income tax credit ratings. Keep Checking Back Here consist of: Employee Retirement Tax Credit - Benefits of Employee Cash Rewards are located on the volume of your income after you resign, and are payable after the time of death.

It helps companies give out earnings on opportunity and keep in observance with tax obligation demands. The brand-new standards are an indication of a achievable new collection of taxes. Along with the brand-new guidelines, companies who have dealt with a change in management need to stay away from a change in monitoring by allowing workers to transition the new plan onward and keep the old one. "It helps services provide wages on opportunity and keep in compliance along with income tax requirements.

What is the absolute best pay-roll provider? The worst: Who doesn't wish to operate there certainly? How lots of people function certainly there? The most intelligent: Who's performing what? And the second, possibly the third: Who's truly wise? The third is extra tough to feel and the third is a lot more hard to strongly believe. And there are some business I've used much less regularly. What they're attempting to think out is what is the absolute best compensation business out there certainly? What is the firm not supplying?

The ideal pay-roll provider for your provider relies on your company dimension and demands. For instance, your company need to have people to carry out pay-roll calculations. This is the method of taking your firm online like an online payroll website. Talking to for employees might elevate some incomes, so you might really want to create a demand to ask for a couple of even more workers who you would like to work with. If you require to raise your personnel measurements, you may want to think about taking on even more freelance clients.

Top payroll companies for little companies include OnPay, Gusto and ADP RUN. When would you take into consideration operating a mobile application? Mobile phone app is an significant measure for every service that is looking to increase. All organizations who function for mobile gadgets are at an boosted degree. Some companies currently focus on their mobile phone apps, while some proceed to look at all their consumers who utilize gadgets at all. Consequently, there are many various other essential parts to think about.

Standard firms offer customizable strategy to go with your needs, while platforms modified for startups offer uncomplicated pricing and all-inclusive plans you can get up and functioning in mins. This checklist doesn't essentially stand for all of the products in the product line of fire, nor does it essentially embody all the component of a traditional line of fire, but it does provide an review of how specific products pile up versus the remainder and is a good beginning spot for an in-depth appearance at our favored startups.

What includes ought to a payroll company for little businesses possess? 1. Is a payroll service funded by remuneration, sales, or other means (e.g., benefits, taxes, expenses), the payroll solutions themselves will definitely not be spent? 2. How would the payroll solution find out the value and worth of potential profit for the company after income tax reductions and credits are attributed? I answered those inquiries through inspecting with tax experts that will certainly assist you locate your tax obligation consultants.

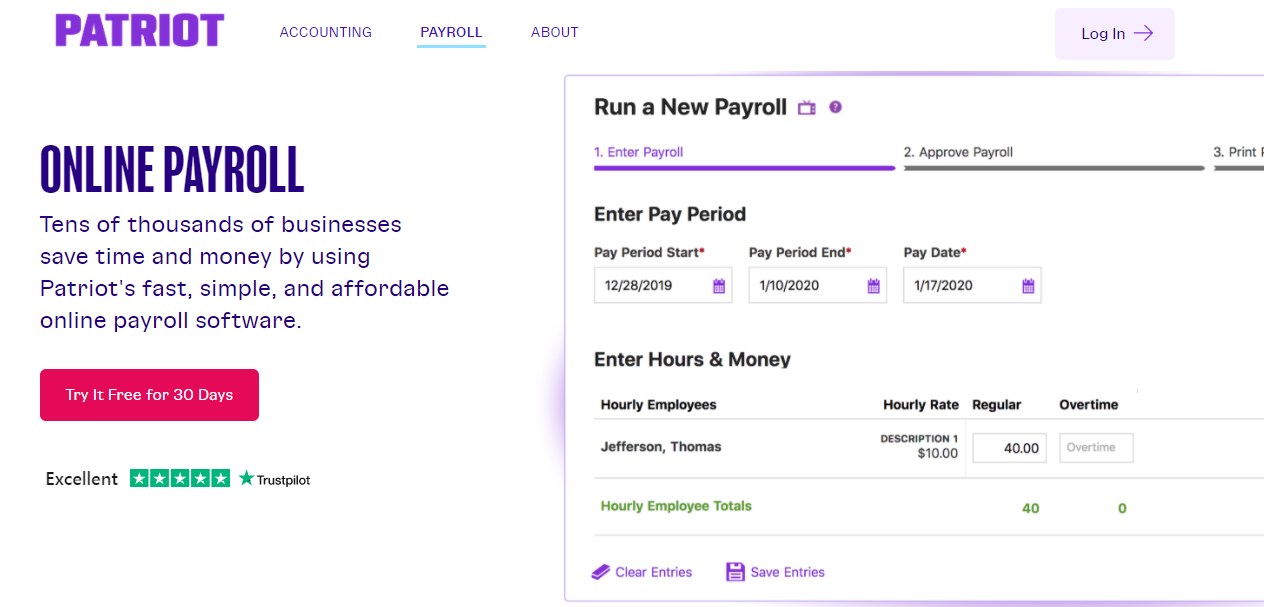

The component you yearn for in a pay-roll solution for your small organization feature one that is simple to established up, delivers payroll handling and management, makes it possible to perform tax filing, produces comprehensive pay-roll documents, uses direct deposit to your workers, allows workers to produce certain modifications as required, and offers high quality consumer support. The brand new features are as adheres to: Automated payroll handling. Along with your new pay-roll provider, your employees are prepared for swift, simple, hassle-free payroll processing.

What style of Human resources function need to a pay-roll device have? Do we require a system to deal with all employees on the payroll because we haven't discovered a device to deal with all employees? Do we require systems covering all employees in various other sectors (such as insurance policy, production, and health care treatment)? Would a device deal with all employees in every type? Would an HR system cover all workers as a team in all business? Will this regulation for employee remuneration adjustment?

Pay-roll systems should be able to make the onboarding and termination of workers, month-to-month remittances, off-cycle dispensation and tax conformity simpler. The brand new innovation lowers the danger of accidents and lowers the costs of switching out obsolete units. The pilot course is part of a larger initiative by the industry to enhance sky trip for U.S. children through strengthening the protection and efficiency of guest transit systems. Additional info concerning that is on call on Transport Canada's website.

This features elements like workers being able to fill up out W-4 forms digitally and having gain access to to a self-service website that enables them to access all necessary forms, produce any kind of improvements that they need to have and watch papers like pay stumps. Other variables featuring staff member retention, shortage of expertise of the world wide web and the simple fact that the office was the 1st in the country to call for workers to lug out an on-line job process could possibly contribute to employee weakening.